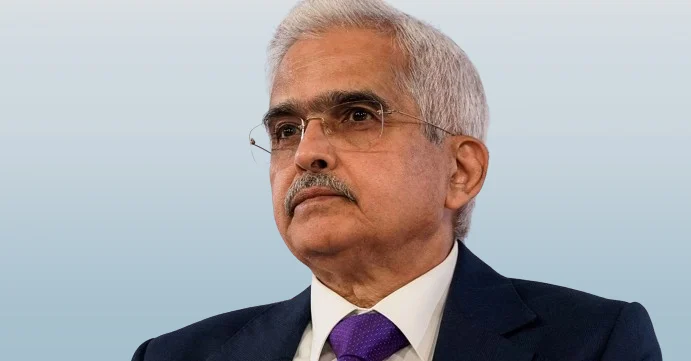

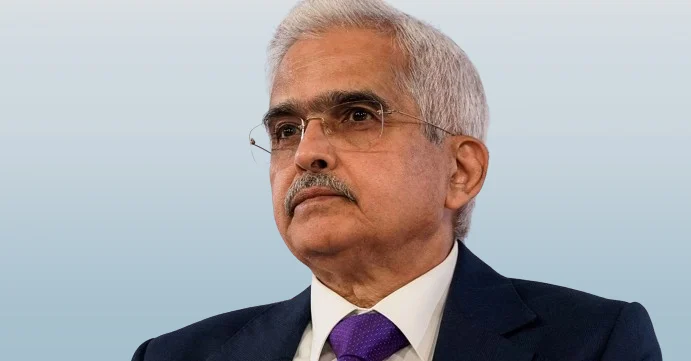

Shaktikanta Das has had a distinguished career spanning several decades in public service, primarily within the Indian Administrative Service (IAS) and later as the Governor of the Reserve Bank of India (RBI). Here is an overview of his career:

Early Career

Indian Administrative Service (IAS): Shaktikanta Das joined the IAS in 1980, belonging to the Tamil Nadu cadre. Over his career, he held various administrative roles at both the state and central government levels.

Key Positions and Contributions

Tamil Nadu Government:

Das served in various capacities, including Collector of Dindigul and Kancheepuram districts. He also held roles in the Department of Industries and Commerce, and the Department of Agriculture.

Central Government Roles:

Joint Secretary, Department of Expenditure, Ministry of Finance: Das played a key role in managing public expenditure and overseeing government spending.

Additional Secretary, Department of Economic Affairs, Ministry of Finance: In this role, he was involved in critical economic policymaking and implementation.

Secretary, Department of Revenue, Ministry of Finance: Das was instrumental in implementing tax reforms and managing revenue collection.

Secretary, Department of Economic Affairs, Ministry of Finance: Here, he was a key figure in major economic decisions, including the rollout of the Goods and Services Tax (GST) and the demonetization of high-value currency notes in 2016. His tenure also involved extensive interaction with international financial institutions and efforts to bolster India’s economic relations globally.

Governor of the Reserve Bank of India (RBI)

Appointment: Shaktikanta Das was appointed as the 25th Governor of the Reserve Bank of India in December 2018.

Monetary Policy: Under his leadership, the RBI has taken significant steps to manage inflation, support economic growth, and maintain financial stability. He has been noted for his pragmatic approach to monetary policy.

Crisis Management: Das has been at the forefront of the RBI’s response to the economic impact of the COVID-19 pandemic, implementing measures to ensure liquidity, provide relief to borrowers, and support the financial system.

Financial Inclusion: He has also focused on promoting financial inclusion and enhancing the digital banking ecosystem in India.

International Engagements

G20 and Other International Forums: Das has represented India in various international forums, including the G20, where he has contributed to global discussions on economic policy, financial stability, and regulatory issues.

Recognition

Awards and Honors: Shaktikanta Das has received several awards and honors for his contributions to public service and economic policy, reflecting his significant impact on India’s economic landscape.

Legacy

Shaktikanta Das is widely respected for his extensive knowledge, effective administrative skills, and ability to navigate complex economic challenges. His career reflects a deep commitment to public service and significant contributions to India’s economic policy and financial stability.